#FRE - CoinJoin: A Complete Technical Guide (October 22, 2025)

Summary: What CoinJoin is, how it works technically, practical variants (Wasabi, JoinMarket, Whirlpool), technical and legal risks, forensic analysis techniques, regulatory framework, historical cases, and a step-by-step checklist for secure usage.

1. What is CoinJoin — Technical Definition

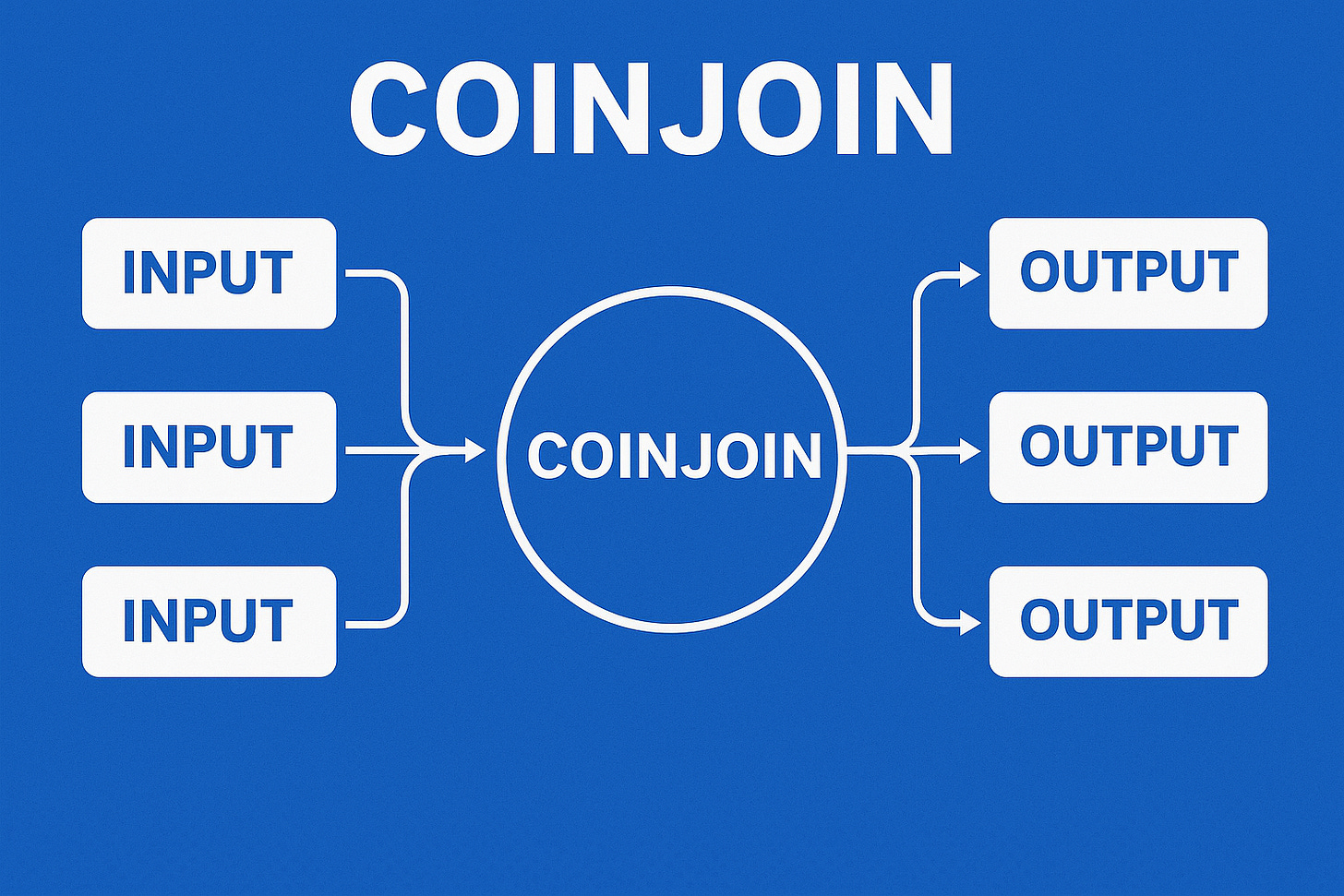

CoinJoin is a family of Bitcoin protocols that enable multiple participants to collaborate on a single multi-input/multi-output transaction, making it difficult to determine which input corresponds to which output.

The goal is to break the deterministic links between senders and receivers on the blockchain.

Unlike custodial mixers, CoinJoin is fully on-chain and non-custodial — it’s simply a transaction built cooperatively by several wallets.

2. How CoinJoin Works (Technical Breakdown)

Coordination Phase: Participants agree to create a CoinJoin. Coordination can happen via a central server (coordinator), a maker/taker model (JoinMarket), or peer-to-peer protocols.

Input Registration: Each participant registers the UTXOs they want to spend.

Output Registration: Each participant provides new Bitcoin addresses to receive their mixed coins. Standard denominations (e.g., 0.01 BTC) enhance anonymity.

Blinded Signatures (Chaumian): In Chaumian CoinJoin (e.g., Wasabi), the coordinator issues blind signatures so it cannot link inputs and outputs.

Transaction Assembly (PSBT): Participants sign their parts of a Partially Signed Bitcoin Transaction.

Broadcast: The final transaction is published on the blockchain.

Variants: centralized coordination (Wasabi), peer-to-peer (JoinMarket), or ZeroLink/Whirlpool (which eliminates non-mixed change outputs).

3. Main Implementations (2025 Overview)

Wasabi Wallet — Uses Chaumian CoinJoin with Tor integration and blind signatures. Open-source and widely maintained.

JoinMarket — A decentralized maker/taker marketplace: makers provide liquidity and earn fees, takers pay to quickly mix coins.

Whirlpool / ZeroLink (Samourai & Ashigaru) — Based on the ZeroLink protocol, avoiding deterministic change outputs. The Whirlpool revival through Ashigaru in 2025 keeps this privacy model alive.

4. Forensic Analysis and De-Anonymization

CoinJoin enhances privacy but is not perfect anonymity. Advanced analytics can still detect patterns:

Input-Output Correlation: Forensic tools analyze value patterns, timing, and reuse of outputs to infer relationships.

Timing Attacks: Observing when participants join rounds and spend outputs can reveal correlations.

Change Outputs: Mixing is weakened if users combine mixed and non-mixed UTXOs. ZeroLink-based systems mitigate this risk.

Recent academic work (2025) introduced similarity measures to probabilistically link CoinJoin output spenders, showing that even robust systems can leak traces when users spend unwisely.

5. Legal and Regulatory Landscape

CoinJoin ≠ Mixer: Regulators often conflate CoinJoin with custodial mixers like Tornado Cash.

The OFAC sanctions on Tornado Cash (2022) and subsequent court challenges (2024–2025) highlight the gray zone between open-source privacy tools and money transmission services.Potential AML/KYC Implications: Running a coordinator that handles others’ funds may be treated as a “money service business” in some jurisdictions.

Evolving EU Framework (MiCA / AMLA): European authorities are increasing scrutiny on tools that “reduce traceability,” though individual use remains legal in most countries.

6. Best Practices for Secure CoinJoin Usage

Use a personal full node (e.g., Bitcoin Core, Dojo) to avoid leaking data to external servers.

Separate wallets: Keep pre-mix and post-mix funds in different wallets.

Wait before spending mixed outputs: Avoid spending immediately after a mix.

Use Tor or private networks for coordination and broadcasting.

Avoid merging outputs: Do not combine mixed and unmixed UTXOs in one transaction.

Stay informed about local regulations to avoid compliance issues.

7. Tools and Resources

Wasabi Wallet — Chaumian CoinJoin implementation with Tor.

JoinMarket — Peer-to-peer CoinJoin marketplace.

Whirlpool / Ashigaru — ZeroLink-based implementation (revived 2025).

OXT.me — Explorer for privacy analysis.

Chainalysis / Elliptic Reports — Forensic trends and detection research.

MIT DCI Research (2025) — On timing attacks and CoinJoin behavior.

8. Historical Cases

Tornado Cash (2022 → 2025):

Sanctioned by OFAC for alleged illicit use, then legally challenged; sparked the debate on whether publishing or using open-source privacy software can be criminalized.Ecosystem Evolution:

CoinJoin implementations continue to adapt—Wasabi, JoinMarket, and Whirlpool remain key privacy infrastructures, with renewed community interest in 2025.

9. Practical Assessment

CoinJoin remains the most effective on-chain privacy mechanism for Bitcoin when used correctly.

However, users must understand its limits: behavioral patterns and forensic advances can still expose identities if operational security is poor.

For developers and coordinators, avoid custodial roles and ensure transparency in code and architecture to reduce legal risk.

10. Conclusion — The 2025 Outlook

Research in 2025 confirms CoinJoin’s robustness yet highlights ongoing risks: timing leaks, behavioral heuristics, and probabilistic clustering remain challenges.

The legal environment is dynamic — courts are slowly differentiating between open-source software and custodial mixers.

For individual users, the key to meaningful privacy remains good operational hygiene: run your own node, use Tor, separate wallets, and understand the limits of statistical anonymity.

✅ Quick Substack Publishing Details

Title: CoinJoin: A Complete Technical Guide (October 22, 2025)

Subtitle: How Bitcoin’s most powerful privacy technique works — protocols, risks, and regulations.

Tags: Bitcoin, Privacy, CoinJoin, Wasabi, JoinMarket, Whirlpool, Guide

Visibility: Free post (educational/technical)

Suggested Cover Image:

(Use the attached blue diagram illustrating inputs/outputs linked to “COINJOIN” — minimalist and educational.)